18th August 2025 — As India accelerates its journey toward decarbonizing its industrial backbone, a revolution is quietly transforming one of its most carbon-intensive sectors:

The rise of green steel — produced with low or zero carbon emissions — is no longer a fringe experiment but a national imperative. And India is now stepping into the global spotlight with bold policy moves, pilot projects, and international interest converging on this sustainability-driven transformation.

Export Pressure Mounts: How U.S. Tariffs Are Rewiring Trade

The newly enforced tariffs cover a wide range of Indian steel products—including flat-rolled coils, welded pipes, automotive steel, and select aluminum components. Indian trade bodies estimate an annual revenue impact of over $2.5 billion.

The U.S. has justified these duties under national security exemptions, shielding them from standard World Trade Organization (WTO) dispute frameworks. In contrast, India views these tariffs as punitive and protectionist, disproportionately hurting emerging-market exporters.

“We anticipate a significant near-term export contraction and adverse pricing effects domestically,” stated a senior analyst from the Indian Steel Export Association.

Why Green Steel Now?

The global steel industry is responsible for about 8% of total CO₂ emissions, with India contributing a significant share as the second-largest producer of steel worldwide. As countries tighten climate pledges and adopt carbon border taxes, Indian steelmakers face a choice: adapt or get priced out of global markets.

“Green steel is not a luxury; it’s a strategic necessity,” says a senior official at the Ministry of Steel. “Without transitioning to low-emission production, we risk losing export markets, investor confidence, and alignment with our own Net Zero goals.”

Technologies Leading the Charge

The transformation is being driven by several key innovations:

- Hydrogen-based Direct Reduced Iron (DRI) technology, which replaces coal with green hydrogen to remove oxygen from iron ore.

- Electric Arc Furnaces (EAFs) using renewable energy and scrap significantly cut emissions.

- Carbon Capture, Utilization, and Storage (CCUS) systems are being tested in both public and private plants.

Several steelmakers have already begun trials. JSW Steel is exploring green hydrogen for DRI at its Vijayanagar plant, while Tata Steel has set targets to increase scrap recycling and use EAFs in new plants.

Policy Moves: Government Steps In

The Indian government is no longer on the sidelines. In December 2024, the Ministry of Steel introduced a formal classification framework for green steel, enabling certification and incentives for low-emission producers.

Key policy support includes:

- Production Linked Incentive (PLI) Scheme for specialty and advanced green steel production.

- Draft carbon taxes and adjustments that favor lower emission footprints.

- Support for scrap policy modernization, digital scrap traceability, and incentives for recycling.

This push also aligns with India’s National Green Hydrogen Mission, aiming to produce 5 million metric tonnes of green hydrogen annually by 2030, with steel listed as a priority application.

The Industry Responds

India’s top private and public sector players are answering the call:

- SAIL is conducting feasibility studies for hydrogen use in its Bokaro and Rourkela units.

- Tata Steel has partnered with the Council of Scientific & Industrial Research (CSIR) on green fuel usage.

- ArcelorMittal Nippon Steel (AM/NS India) is investing in renewable energy and decarbonization R&D.

These initiatives are supported by foreign collaborations, including technology partnerships from Europe and financing interest from climate-focused funds.

Green Steel as a Global Differentiator

Border Adjustment Mechanism (CBAM) begins phasing in from 2026, steel exporters will face carbon taxes unless they demonstrate cleaner production.

By embracing low-emission steel, Indian firms can:

- Retain export access to Europe and the US

- Qualify for premium pricing in sustainability-conscious markets

Attract ESG-focused investments and supply chain partners

Economic and Regional Impact

Beyond the environment, green steel is opening new job opportunities, especially in renewable power, automation, hydrogen logistics, and materials testing. Clusters in Odisha, Gujarat, and Maharashtra are emerging as early hubs for this ecosystem.

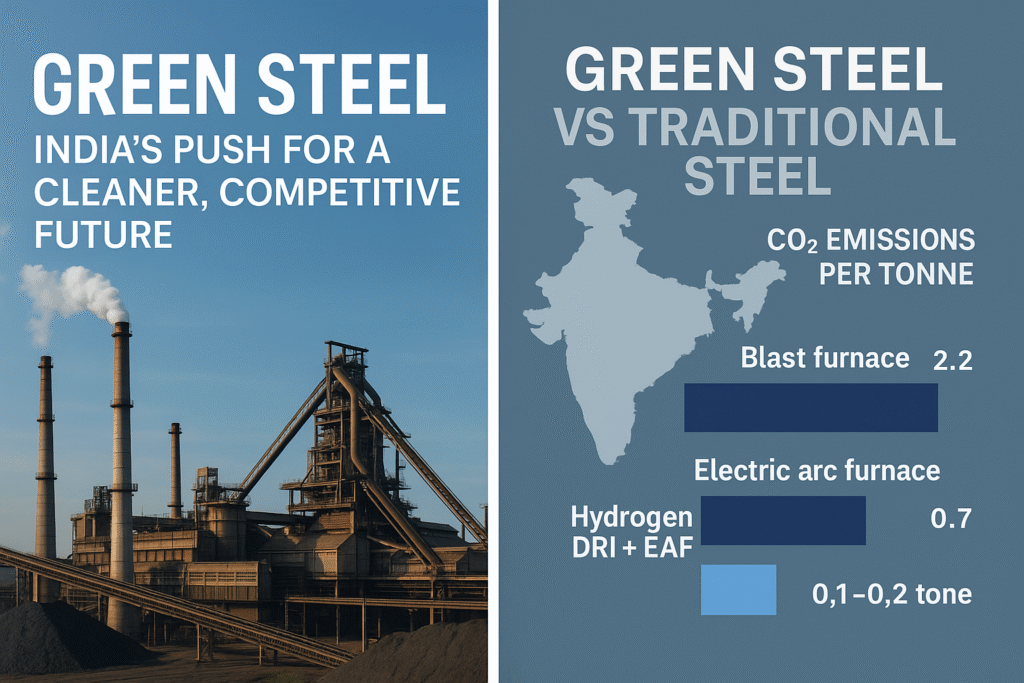

“Green Steel vs Traditional Steel: CO₂ Emissions per Tonne”

- Blast Furnace: 2.2 tonnes CO₂

- Electric Arc Furnace: 0.7 tonnes CO₂

Hydrogen DRI + EAF: 0.1–0.2 tonnes CO₂

India’s Moment to Lead

India’s path to green steel is ambitious but feasible. It requires continued investment, coordinated policymaking, and technology diffusion beyond large players to SMEs. If executed well, India has the opportunity not just to decarbonize but to lead the world in sustainable metallurgy.

“Green steel will define the next chapter of industrial growth,” says a recent report by NITI Aayog. “And India must write it first.”

Explore Our Solutions for GCC & Africa

From industrial pipes and structural beams to custom stainless components, Stellanox Steel is your regional stainless steel partner.

🌐 Visit us: https://stellanoxsteel.com

📧 Email: sales@stellanoxsteel.com

📍 HQ: Dubai, United Arab Emirates